more

Close

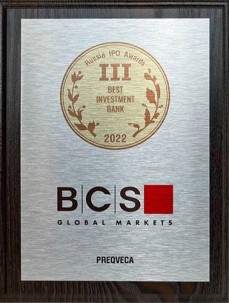

BCS Global Markets Scoops Two Prizes at the Russia & CIS IPO Awards

BCS Global Markets topped the pedestal in the IPO of the Year category for its role as a bookrunner in SPB Exchange’s IPO and finished third in the Best Investment Bank category.

The awards ceremony took place during the Cbonds Congress IPO 2022 conference.